The state of sustainability reporting instruments worldwide3 min read

Communication is important and it matters even more if involves Environmental, Social, and Governance (ESG) issues.

While the Sustainable Development Goals (SDGs) have gained prominence, however, the explicit reference to SDGs in disclosure requirements remains limited.

In this context, the 2020 edition of Carrots & Sticks (C&S) Report (link) assesses the regulatory landscape of non-financial and sustainability reporting. It tracks global trends in what is required of reporters.

It also took into consideration the perspective of policymakers to gather their views on disclosure provisions, possible market saturation, and ways to progressively develop better policies.

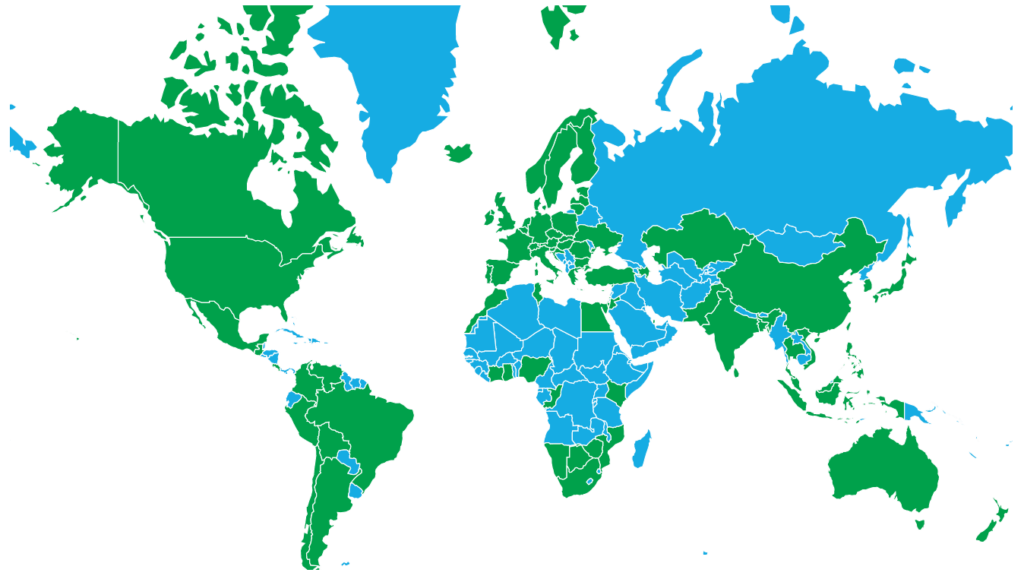

The picture below depicts the state of the art of sustainability reporting instruments worldwide.

In blue the countries with no sustainability reporting instruments.

In green the country with (mandatory and voluntary) instruments that either require or encourage organizations to report sustainability-related information.

The main insights emerge from the analysis:

- Governments and financial regulators remain the most active in issuing reporting requirements and guidance (reporting provisions), followed by stock exchanges and industry bodies. New regulatory requirements have been issued, both voluntary and mandatory, with a sharpened focus on human rights, work and climate change. Voluntary codes and guidance continue to drive innovation. In parallel, there has been a push for stricter requirements for mandatory reporting to advance reliable and comparable disclosure in more developed markets.

- Europe still dominates the sustainability disclosure agenda while Asia is an active up-and-comer. The biggest discrepancy in voluntary versus mandatory approaches can be seen between North and South America, where North America has the highest proportion of mandatory reporting requirements. Meanwhile, hybrid or “comply or explain” approaches are seen worldwide.

- Large and listed companies are still the main targets of reporting provisions. Sector-specific approaches are becoming more common, with financial services and heavy industries the most targeted.

- The ESG&E (environmental, social, governance, & economic and general) agenda continues to provide an evolving set of potentially material topics. Climate change, human rights, labor and anti-corruption are dominant themes among disclosure requirements. In the category of economic & general, the themes of trade, business models and supply chains receive high interest. Indirect economic impact, including themes such as infrastructure and economic development, have received less attention.

- The interest in progressing the implementation of sustainability commitments is confirmed by greater demand for relevant data, including disclosure of verified statements. This is supported by interest from data collectors, aggregators and investment analysts. Disclosure types and reporting formats, meanwhile, remain diverse.

Source: Carrots and Sticks (C&S), Carrots & Sticks 2020 – Sustainability reporting policy: Global trends in disclosure as the ESG agenda goes mainstream. Global Reporting Initiative (GRI) and the University of Stellenbosch Business School (USB) (link)

Featured image by Schwoaze from Pixabay