Is sustainability only for large companies?5 min read

Why should a company address sustainability and implement ESG practice even if it is a small or medium business?

When it comes to sustainability in business, it is not unusual to think of a corporate world, made up of large players and organizations.

Certainly, the ability of a company to address environmental, social, and governance (ESG) strategy as part of its business is becoming an integral part of the operations.

For the (few) companies that have not yet integrated these concepts into their strategy and are understanding how to implement them, the timer has come. This is an organizational innovation that will permeate actions in the near future. For companies of all sizes and sectors.

It is clear that large corporations – particularly listed companies – have greater obligations in relation to sustainability. It is no coincidence that the Securities and Exchange Commission (SEC) has also decided to strengthen efforts on these issues (SEC Announces Enforcement Task Force Focused on Climate and ESG Issues).

Looking overseas, the EU’s Non-Financial Reporting Directive, a.k.a. NFRD (Directive 2014/95/EU) requires that companies with 500+ employees disclose information on how they operate in relation to the management of social and environmental issues. More in detail:

- environmental matters;

- social matters and treatment of employees;

- respect for human rights;

- anti-corruption and bribery;

- diversity on company boards (in terms of age, gender, educational and professional background).

However, the growing attention towards ESG factors means that some adjustments must now be concretely evaluated even by small companies. Otherwise, the risk is the progressive exclusion in favor of other competitors more advanced in the ESG area. And with better relations with the company’s stakeholders (investors, shareholders, customers, suppliers, financial institutions, regulators, community, etc.).

Pros

Company value

For the company that takes into account the ESG objectives, the advantages may be different.

First of all, the improvement of the perception of company value and, in the end, a real improvement of the valuation as a company. According to some studies (one of them here by McKinsey), companies attentive to ESG factors are generally less exposed to operational, legal, and reputational risks. And also more oriented towards innovation and efficiency in the allocation of resources and in the assessment of risks (related to business activities and to the environment).

As a result, investors are more interested in companies that carry out their business activities with a view to sustainability (Integrating ESG factors in the investment decision-making process of institutional investors – OECD).

Access to financial market

Credit and banks

Also from a financial point of view and, in particular, access to credit, banking institutions set selection criteria with greater weight being attributed to factors that favor sustainable growth. The aim is obviously the enhancement of the customers’ social responsibility and the improvement of the management of financial and reputational risk, consistent with effective management of corporate portfolios.

It is also necessary to consider that any positive actions in this area, the achievement of the set objectives, and the constant disclosure of information on ESG issues, however, facilitate the company to maintain a level of high and constant quality over time. For example, corporate reporting on the CO2 emissions of a product is no longer limited to the mere cycle of production and distribution but must include the entire life process.

Investors

In the recent Larry Fink’s Annual 2022 Letter to CEOs, the CEO of BlackRock dedicated an entire section to sustainability, in its environmental, social, and governance aspects.

Interesting is the section where he says the next 100 unicorns will not be social media or search engines (not so explicit references to the successes of Facebook, Google, Instagram, TikTok, and so on) but scalable and sustainable startups. Therefore they will already have a well-defined social purpose, with sustainability embedded in their activities.

The next 1,000 unicorns won’t be search engines or social media companies, they’ll be sustainable, scalable innovators – startups that help the world decarbonize and make the energy transition affordable for all consumers.

Larry Fink (BlackRock CEO)

Another step that must make us think – among other things – is the one in which BlackRock’s CEO says that all challenges in sustainability (i.e. transition to the net-zero world) will transform companies. The question is whether these same companies will lead the transformation or just adapt.

It is therefore clear from this letter that sustainability is a business for all companies, be they small, medium, large, newly born, or with years of experience behind them.

Quality level

The correct adoption of the ESG criteria provides potentially important information on quality levels. Especially from the point of view of end consumers, who will be more incentivized to use the goods and services of those companies that have chosen a more inclusive business approach. It is no coincidence, for example, that large-scale distribution increasingly requires suppliers to comply with ESG criteria.

The transition from mere profit objectives to sustainable choices is not without risks. Managers in risk evaluation (physical and transitional) must take due account of the specific business reality (human and financial resources required) in order to plan a gradual and constant transition over time.

If you want to learn more about the internal departments that should speak the ESG language, read more here.

Conclusion

If the initial costs may be significant (think for example of the replacement of the car fleet to reduce the CO2 emissions of a company operating in the logistics), the overall cost/benefit assessment in the medium-long term shows that the latter clearly exceeds the former.

On the other hand, national and international institutions are already taking steps – or ready – to define a merit-based evaluation system. The aim is to reward ESG-oriented companies (i.e. with a more favorable fiscal treatment) if they chose sustainable development.

This is certainly an incentive to support a change toward a more sustainability-oriented approach. And even when there is no immediate support from institutions, the market certainly rewards the most virtuous business models in the long run.

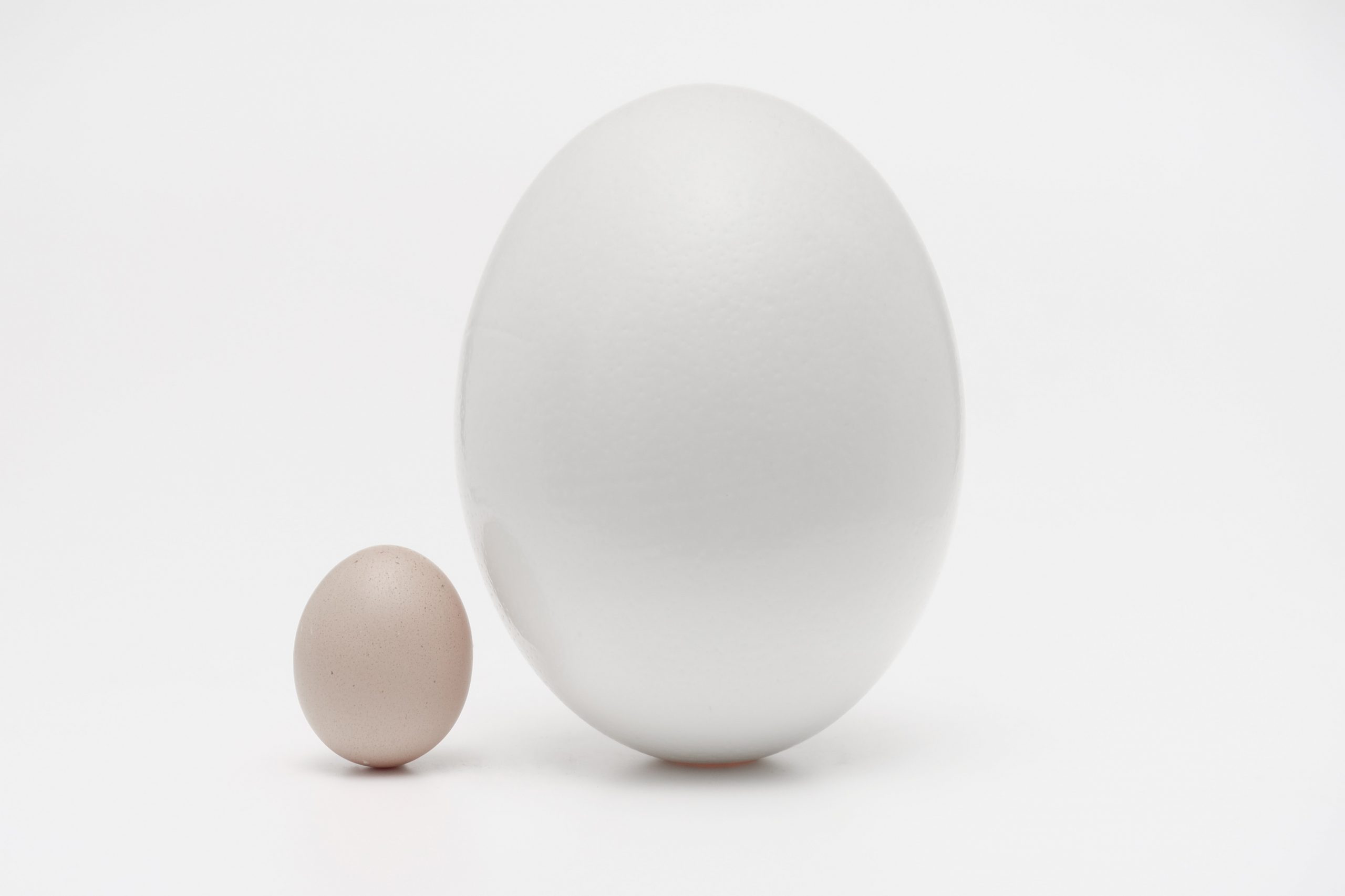

Featured image by Daniele Levis Pelusi on Unsplash