Chia Coin: the green alternative to Bitcoin6 min read

February 2021. Tesla announces its investment in Bitcoin for 1.5 billion. This piece of news immediately increased the value of the digital currency that reaching a record of 63,000 dollars in mid-April 2021.

After a few weeks, a tweet from Elon Musk – where he announced the stop to Bitcoin as a means of payment for Tesla cars – was enough to generate an immediate collapse. The reason? Bitcoin production is a major source of pollution: on the one hand, because a considerable amount of energy is used to produce them, on the other for the quantity of hardware and computer components that is consumed (and literally burned) for the mining process.

The mining process, in fact. In general, every cryptocurrency has its own method for verifying transactions. The creation of cryptocurrencies takes place typically by using the collective computer power of miners, who are paid for their “help” in increasing it. The work of these numerous high-powered computers is an energy-intensive process that often requires fossil fuels such as coal, one of the most polluting.

The hardware components are also put to the severe test: the miners obtain crypto through complex mathematical calculations carried out by the GPU (graphics processing units) of the computers and extrapolate the cryptocurrency through calculation systems linked to expensive energy consumption. This leads to quickly wearing down many components and accelerating their life cycle for which they were originally intended. In this way, waste materials are generated much more quickly, deriving from the use of the GPU in cryptocurrency mining, which also requires subsequent disposal.

It is therefore not surprising that the surge in prices, fueled by investors’ FOMO (“fear of missing out”) and momentum, leads to an impact on the environment so great that it jeopardizes the global use of cryptocurrency.

Fortunately, new projects in the world of cryptocurrencies stand as valid alternatives to Bitcoin and – in general – to less sustainable digital currencies from an environmental point of view. These are new cryptocurrencies that reduce emissions related to transactions and mining. One of the pioneers in this is certainly Chia Coin, managed since 2017 by the Chia network, founded by Bram Cohen, which aims to reduce the environmental impact thanks to the “proof of space and time” system: in this case, the extraction process is called “farming”, and it simply exploits software for Windows and Mac by relying on the free memory space on the hard drives. However, it requires electricity, but it is beyond question that it leaves a much less marked footprint on the environment, this is because the “proof of work” method, used to mine Bitcoin and most digital currencies, is totally replaced.

Chia’s “proof of space and time” allows network participants to show that they have been physically storing data over a certain period of time. This doesn’t resemble the mining process of cryptocurrencies. In their current iteration, they use proof-of-work, which requires a massive amount of computer power to harvest and mine the decentralized coin. It’s worth noting that there are newly proposed approaches for first-generation cryptocurrencies (i.e. Ethereum 2.0) that would use a proof-of-stake model, which is allegedly more energy-efficient.

The Chia Network has a blockchain transaction platform called mainnet (version 1.0 released on March 17, 2021), which can be downloaded on the Chia network website. To start farming, it will be just necessary to download this program to the computer and allocate a certain amount of space to the network through the user interface. It involves completely normal hardware rather than super custom and expensive stuff. And since “farming” doesn’t use a ton of energy, laptops can be used without too much trouble.

Chia is green money according to the founder Bram Cohen who started the company to reduce the energy dependence of blockchains through a “green” option. The concept of farming seemed to be the best metaphor for filling unused disk space and monitoring it for winning sprouts. This led the company to look for a grain that had the properties necessary to embody with the new Network. Chia Network was then born.

The Chia “farming” process is a greener mining alternative to Bitcoin & co., but it does still require electricity.

“Plotting” (the process of creating plot files that are later harvested as part of the Chia farming process) still uses computer hard drive space and CPU power, but it requires significantly less energy than what is required for the mining process for other proof-of-work cryptocurrencies.

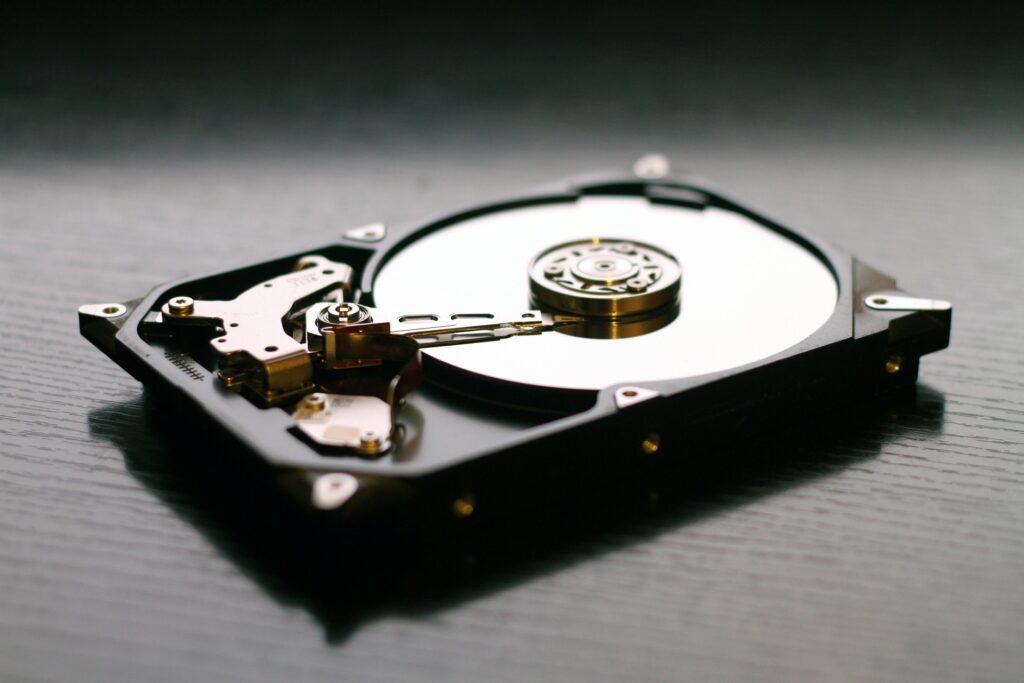

According to several sources, including the President and COO Gene Hoffman, Chia has in fact caused an increase in demand for hard drives since it was launched. The hard disk space for Chia mining has grown exponentially since the launch in March 2021 (link).

But how does practically work? The “reward” for farming comes from the fact that there is a plot chosen every few seconds as a validation method for a specific transaction. If your plot is chosen, Chia Coin is the prize. Clearly, the odds of any individual plot being chosen at a given time are minimal, but the greater the number of plots, the more likely it is to be picked. After plots are generated on a PC, the most cost-effective and power-efficient way is to copy them to an external drive and use them to farm Chia Coin on a Raspberry Pi (learn more here).

If you’re satisfied to just make a few plots, plug them into an always-on Pi and let it rest, using a high-capacity hard drive. But if you want to keep building new plots, you’ll need to keep buying more and more high-capacity hard drives to hold them.

All of this had (and will continue to have) a cascading effect that also fell on end-users, as the increased demand for memory resulted in significant increases in hard drive prices, particularly high-end models. However, the same Gene Hoffman believes that in the long run, increased demand will lead to a reduction in the cost of memory as manufacturers regulate assembly lines.

Long story short. The matter is not easy. The moment is decidedly “hot” both as regards the gains deriving from electronic currencies and the long-term impacts that these may have. But having opened the discussion (and provided green alternatives) to the use of cryptocurrencies that apparently are not environment-friendly is a step towards responsible investments with the use of a lower amount of resources.

Sources: Chia Network, Chia Network FAQ

Featured image by db_oblikovanje from Pixabay